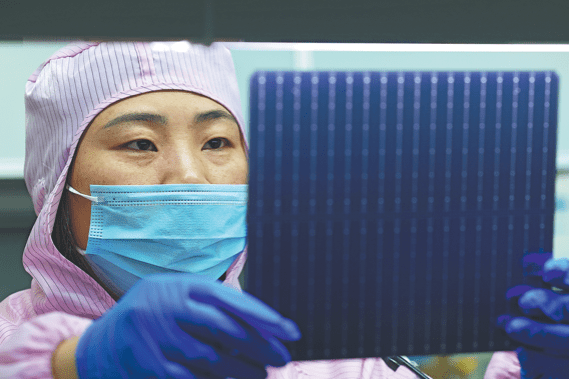

An employee works on a PV panel production line in Maanshan, Anhui province, on Nov 21. WANG YUSHI/FOR CHINA DAILY

An employee works on a PV panel production line in Maanshan, Anhui province, on Nov 21. WANG YUSHI/FOR CHINA DAILY

China will scrap value-added tax rebates on photovoltaic products from April, signaling a decisive shift away from what industry experts see as subsidized overseas expansion.

They said the decision could trigger a short-term surge in overseas orders ahead of the deadline, but would ultimately accelerate consolidation in a sector grappling with falling prices, mounting losses and growing trade frictions.

In a joint notice late last week by the Ministry of Finance and the State Taxation Administration, VAT rebates for battery products will be cut from 9 percent to 6 percent between April and December, before being fully scrapped from Jan 1, 2027.

The adjustment builds on an earlier policy shift announced in November 2024, when China lowered export rebate rates for solar wafers, cells and modules from 13 percent to 9 percent.

Wang Bohua, honorary chairman of China Photovoltaic Industry Association, said: “The adjustment to the tax rebate policy has eroded the low-cost advantage of directly exporting PV modules, prompting firms to accelerate the shift of production capacity overseas. The new policy, in the long term, will help adjust the overall export structure of solar-related products, and help companies release capacity in regions including the Middle East, Latin America and Southeast Asia, to bypass hostile trade barriers.”

Wang said overseas capacity expansion in markets such as India, the United States and Southeast Asia is already reshaping China’s export structure, and exports of solar cells, rather than finished modules, have grown significantly faster.

Several industry sources told China Daily that overseas buyers are front-loading orders during the remaining policy window, creating a temporary spike in exports.

Zheng Tianhong, a senior analyst at Shanghai Metals Market, said, “Related output could rise sharply in the months leading up to April 2026 as manufacturers seek to take advantage of the final rebate window.”

However, the end of export rebates will also raise costs materially. Zheng expects that after rebates are removed, export profits for a standard solar module could fall by 46 to 51 yuan ($6.40-$7.10) per unit, compressing margins and intensifying pressure on less efficient producers.

The CPIA said in a statement last week that some exporters had effectively converted tax rebates into bargaining chips for foreign buyers, allowing overseas customers to capture benefits originally intended to offset domestic VAT burdens.

“This has turned export rebates into a de facto subsidy for overseas markets,” the association said, warning that the practice had eroded corporate profitability and heightened the risk of antidumping and countervailing investigations against Chinese solar products.

“Reducing or cancelling export rebates at an appropriate time will help restore rational pricing in overseas markets, lower trade friction risks and ease the fiscal burden,” the CPIA said.

Contact the writers at [email protected]

Tanks to chinadaily.com.cn

Please visit:

Our Sponsor

Like this:

Like Loading…

Разгледайте нашите предложения за Български трактори

Иберете от тук

Българо-китайска търговско-промишлена палата