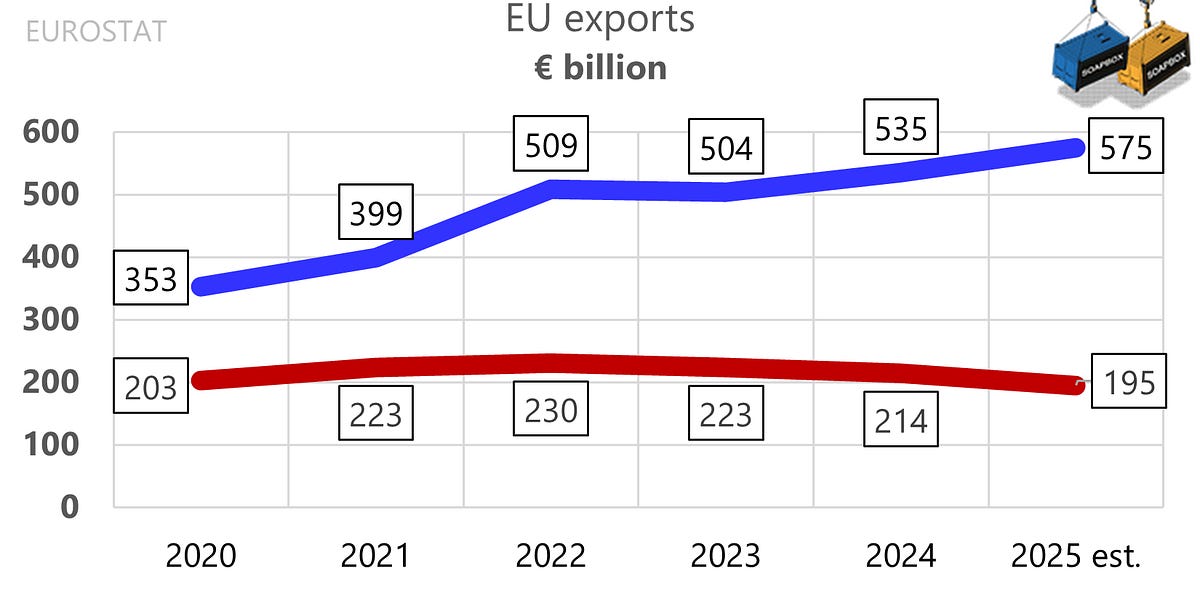

In 2025, EU exports to China are set to be 44% below exports to the UK and more than 10% below exports to Switzerland. Over the past five years, the export gap in the U.S.’s favour has widened by €230bn.

On 16 December, China’s Trade Remedy Investigation Bureau issued its final ruling, determining that imports of certain pork and pig by-products originating in the EU were dumped. The anti-dumping duty rates for individual EU suppliers are listed below. Suppliers not included in the list are subject to a 19.8% duty.

The CIF price per unit of volume drops 10% compared with October last year.

For curious readers: Canada (0%), the U.S. (0.03%), and Japan (1.6%).

Notice the Greek export boom to China in 2024–25 is off the chart. It turns out to be entirely a fuels story. Re-exports / refined fuels produced in Greece from imported crude, shipped to China when the arbitrage works.

Notice the Greek export boom to China in 2024–25 is off the chart. It turns out to be entirely a fuels story. Re-exports / refined fuels produced in Greece from imported crude, shipped to China when the arbitrage works.

China publishes a vast amount of data. The challenge is that it is often hard to pin down what the numbers actually measure. Definitions shift, samples change, base periods are rebuilt, and voilà, the headline remains clean.

Spend enough time with the data released and a pattern emerges. The system is designed to minimise surprises. Accuracy matters, but not to the extent of risk control. A weak reading can invite blame or raise public concern. A more stable presentation buys time and reduces the chance of abrupt shifts in expectations.

There is also a bureaucratic logic at work. Unwelcome news tends to travel upwards with a name attached, so people become cautious about being the one to deliver it. In a hierarchy, the first question becomes “what is the official narrative?” Once a storyline is set such as “recovery is on track”, or similar, it is difficult for anyone to acknowledge a miss. Doing so can look like a loss of credibility and can force awkward public revisions. That is never rewarded.

Finally, “confidence” is treated as a policy variable in its own right. If sentiment is believed to drive spending and investment, then candour is managed carefully. None of this is unique to China, but it is unusually consequential at China’s scale. The trade-off is straightforward: fewer rough edges in the data today, but weaker trust and a poorer diagnosis tomorrow.

One example is a recent speech by Ma Jiantang, former head of the National Bureau of Statistics. Ma takes a fuzzy goal, “become a mid-level developed country by 2035”, and turns it into a single number. He looks at a group of countries he classifies as mid-level developed, takes their average GDP per person in 2022 (about US$23,000), and suggests that if China reaches roughly that level by 2035, it can credibly claim the same status. Notice the sleight of hand: he treats a frozen 2022 snapshot as if it will still be the benchmark in 2035, even though those countries’ incomes will almost certainly be higher by then.

Free ports and special customs supervision zones are common globally, so long as they stay within WTO guardrails. But the devil is in the details. One especially interesting feature now being reported is that goods with ≥30% “local value-added” in Hainan can enter the mainland tariff-free. This can be framed as an origin/processing rule, but it is likely to raise questions, above all about how that 30% value-added is calculated.

In the meantime, the initiative has been praised by WTO deputy director-general Zhang Xiangchen, though it is not exempt from scepticism elsewhere.

In 2025, EU imports of Wi-Fi routers are set to rise by €2 billion, green coffee beans by €1 billion, and motherboards and other printed circuit boards (PCBs) by €1.2 billion. The EU’s deficit with Vietnam in 2025 will be twice the level of five years earlier, when the free trade agreement entered into force.

So far, the agreement looks unbalanced. EU exports to Vietnam have grown by an average of 7% a year, which is strong. But EU imports from Vietnam have increased by around 13% a year on average.

In what sounds like an ultimatum Brazilian President Luiz Inacio Lula da Silva said on Dec 17 that if the trade agreement between the European Union and the trade bloc Mercosur is not finalized this month, Brazil will no longer sign off on the deal.

To better understand Lula’s harsher tone (and China’s position), it helps to note that China’s trade balance with Mercosur is two-sided: a US$43bn deficit with Brazil, versus a US$9bn surplus with the rest of the bloc (Argentina, Bolivia, Paraguay and Uruguay).

For the EU, our estimate is that it will run a trade surplus with Mercosur in 2025. The surplus with Argentina, Paraguay and Uruguay combined should reach €4.1bn, partly offset by a €1.7bn deficit with Bolivia and Brazil, leaving a net surplus of €2.4bn with the bloc.

Most offshore yuan payments are concentrated in Hong Kong and a few financial centres. Outside those hubs, yuan use in SWIFT payments remains limited.

Through November, China’s exports are up 5.9% year on year in US$ terms. To preserve that pace for the full year, December exports would need to rise about 11% YoY, because December 2024 was unusually strong, driven by front-loading ahead of President Trump’s inauguration in January 2025. We see little chance of a repeat. Our baseline is that full-year 2025 exports will total around US$3,725bn, implying about 4% growth over 2024.

Total imports look almost flat (-0.6%), but that’s largely because processing and assembly imports jumped (+11.1%) even as general trade imports fell (-4.4%).

Without that surge, the overall import picture would have been materially weaker, at roughly -2% rather than near-flat.

China’s retail sales grew just 3% in January–November 2025. Over 2021–2025, the CAGR is only about 3.4%. More worrisome, November slipped by 0.42% from October.

During COVID controls, “I want to go abroad” (出国) became a recurring theme on Chinese social media. Outbound travel spending is back by 2024 and remains firm in 2025 (Jan–Oct based estimate), but the long-hyped “revenge travel” moment never really turned into a surge, perhaps because household sentiment is still weak.

Thanks for reading! Subscribe for free to receive new posts and support our work!

We are committed to sharing with you the best trade analysis we have to offer.

If you would like to share something with us, feel free to comment in the section below or drop us a line at [email protected]

Like this:

Like Loading…

Разгледайте нашите предложения за Български трактори

Иберете от тук

Българо-китайска търговско-промишлена палата