It also avoids admitting that there is a deep demand-side problem. Acknowledging that the main constraint is that people do not feel secure enough to spend would imply stronger social transfers, income redistribution, and a clearer backstop for local finances and households. All of that is politically and ideologically more sensitive.

Instead, the leadership frames the issue as a supply-side imbalance. This fits the existing playbook and helps justify a continued push into favoured sectors. It legitimises the industrial policies they already want to pursue, while deflecting from a more uncomfortable conversation about household incomes, housing-related wealth losses, and the weakness of social safety nets.

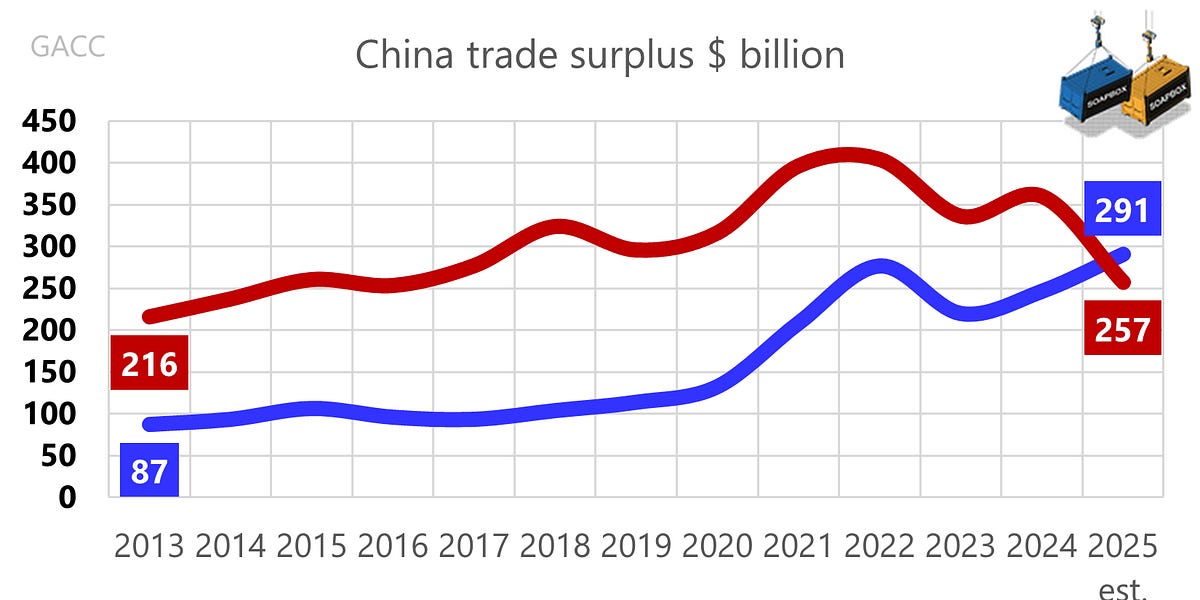

The sense of déjà vu comes from how little the underlying message has changed. Behind the polite praise and slightly higher growth forecast, the IMF is still pressing the same points it has repeated for years: China relies too heavily on exports and investment, domestic demand is too weak, and the property sector plus local government debt remain major sources of risk. The prescription is also familiar: shift to a more consumption-driven model, strengthen the social safety net so households save less, clean up property and LGFV balance sheets, and scale back inefficient industrial policy support.

The 2025 text updates the numbers and puts more emphasis on deflation and trade tensions, but the basic diagnosis is almost identical to previous IMF visits to China, so apart from a few details we could be reading a draft from an earlier mission, hence the déjà vu.

On 4 April 2025, China extended its export controls on rare earths, including metals and compounds. We review the EU’s import dependence on Chinese supplies in volume terms. At the time, the European Central Bank (ECB) carried out a value-based vulnerability analysis. As the year draws to a close, our quantity-based assessment of the EU’s dependence on China reveals a much starker picture.

On 4 April 2025, China extended its export controls on rare earths, including metals and compounds. We review the EU’s import dependence on Chinese supplies in volume terms. At the time, the European Central Bank (ECB) carried out a value-based vulnerability analysis. As the year draws to a close, our quantity-based assessment of the EU’s dependence on China reveals a much starker picture.

Guinea is not an exception, it is the playbook. In many African countries, China’s trade is dominated by unprocessed commodities flowing out and little else, and Simandou mine will only deepen this extractive pattern.

As of 1 July 2026, goods entering the EU in small consignments and valued at less than €150 will be subject to a fixed €3 customs duty.

Council agrees to levy customs duty on small parcels as of 1 July 2026 – Consilium

It drags down also shipments from the Bratislava hub in Slovakia.

A few hours after the state visit to China ended, fresh data showed how little had changed. From January to November, China’s trade surplus with the EU rose by 20%, to ¥1.9 trillion from ¥1.5 trillion a year earlier.

Xi treated Macron’s appeal in line with standard practice: ignore the objection, then reframe it later in familiar rhetoric and jargon, with no real intention of addressing the substance.

See here

On December 10, Mexico approved tariffs on 1,463 products, most of them imported from China. The decision brings Mexico’s trade posture closer to that of the United States. China is expected to export more than $10 billion in cars and auto parts to Mexico in 2025. While Mexico enjoys a $174 billion trade surplus with the U.S., it runs a trade deficit of more than $70 billion with China.

On June 30, China’s Ministry of Commerce warned countries against making trade deals with the United States that compromise Chinese interests in exchange for so-called “tariff relief.” President Sheinbaum, however, insists the measure has nothing to do with China and is instead aimed at advancing Mexico’s industrialization.

Driven by containerships, tankers and dozens of Ro-Ro ships, China’s ship exports will reach $64 billion in 2025, double the $32 billion recorded two years ago.

Even in a year when the Mid-Autumn Festival and China’s National Day were combined into an extended holiday period, SAFE’s gauge of travel services imports shows a rise of barely 1% for January–October compared with 2024. Perhaps the number of travellers is up, but they are clearly keeping a tight hold on their purse strings.

We are committed to sharing with you the best trade analysis we have to offer.

If you would like to share something with us, feel free to comment in the section below or drop us a line at [email protected]

Like this:

Like Loading…

Разгледайте нашите предложения за Български трактори

Иберете от тук

Българо-китайска търговско-промишлена палата